Words: Gentleman's Journal

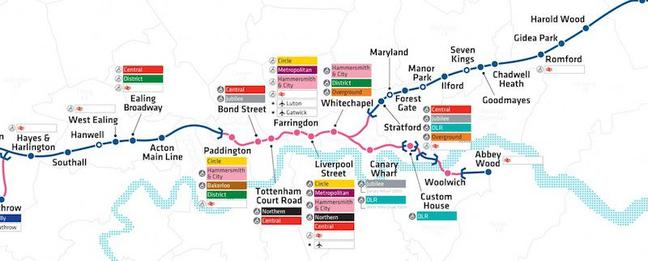

As if there weren’t enough factors pumping up the value of London property to historic highs, the looming completion in 2018 of Crossrail, zooming through the Capital from Maidenhead in the west to Shenfield (Essex) in the east, will add a further blast of oxygen.

Before a single train has emerged from Crossrail’s giant tunnels, real estate prices have already had an uplift worthy of Montgolfier, sailing at least five per cent higher than the average for their area. In some cases, such as Bond Street, the outperformance since 2008 has been a stellar 38.4 per cent. Outside Central London, values close to the Acton station have leapt by 33 per cent above the district norm since 2008, according to figures from Knight Frank.

In a city where car travel has become inconvenient, expensive and slow, living near a high speed rail link which can deliver you into a major metropolis within 45 minutes is a massive boon. Crossrail will bring an additional 1.5 million people into this magic circle, according to Knight Frank. The company points out that, together with reduced travel times, large regeneration projects connected with Crossrail are raising the level and choice of amenities, along with new residential options.

Schemes with almost 3,000 residential units are underway within 10 minutes’ walk of central Crossrail stations, along with another 10,000 that have planning approval. So the scheme may contribute, indirectly, to alleviating the Capital’s housing shortage.

“London is one of the least densely occupied of the world’s major cities,” says Stephanie McMahon of Strutt & Parker agency. She sees Crossrail as an opportunity for the industry to build out some of the less fashionable areas of London. “If you look at an area like Hayes, there’s lots of industrial property which could become residential.”

And the entire Crossrail project, both the current scheme which will complete in 2018 and Crossrail 2, due to begin construction in 2020 and launch in 2030, will help to rebalance London, reinvigorating the east, north and south, which have lost out to the west in recent decades. “Crossrail 2, in combination with the planned Bakerloo underground extension line, could attract major investment in property,” says McMahon.

Areas including Hayes, the Old Kent Road, Dalston and others further north and south are likely to gain significantly from these two projects in the coming 15 years. “The dynamism of the city is changing,” says McMahon. “In an area like Farringdon, which is on Crossrail 1, the residential price per square foot has gone up from £800 in 2008 to £1,500 today. This is an extreme example but it shows the uplift that has taken place.”

For some, constant property price inflation is nothing to cheer. Young people have gravitated to the east of the city in search of affordable accommodation with sufficient access to the centre of town. Rising prices may cut off even this source of home ownership from all but a small minority, together with wealthy overseas buyers and commercial landlords.

Others point to the wider regeneration advantages that Canary Wharf, the Jubilee Line extension, the Olympics and now Crossrail 1 have brought to the East End of London, bringing jobs and investment to a formerly blighted area. Crossrail 1 by itself has created around 10,000 jobs over the construction period, and ‘supported the delivery’ (as Crossrail puts it) ‘of over 57,000 new homes and 3.25 million square metres of commercial space’.

There is a running debate between those who see ‘regeneration’ as a code-word for corporate exploitation, through which lower-paid workers and even the middle class are effectively excluded from financial participation in major cities; and the more positive outlook of those who welcome modern, efficient, higher quality infrastructure and amenities and think higher property prices are a necessary adjunct (or in fact a welcome result, since they stand to profit).

For Stephanie McMahon at Strutt & Parker, the Crossrail developments are distinct from any such debates about the general property market. “Higher property prices are a result of international investment in London, a rising population and a lack of supply,” McMahon points out. “London needs infrastructure, it has to transport people safely, healthily and quickly, and it needs more affordable housing options such as multi-family blocks as you see in the United States and elsewhere.” Crossrail, she says, has been talked about for decades, as a means of relieving the pressure on London’s transport system as the Capital’s forecast population continues to expand.

Without a change in approach from government to create significant volumes of new housing, with the present administration seeking to privatise yet more social housing through ‘right to buy’ schemes, the pressure on London’s property market may grow yet more intense, despite the schemes that are popping up along the route.

While Crossrail will help to alleviate some infrastructure bottlenecks – it is expected to add 10 per cent to the city’s overall supply of public transport – it could have the opposite effect on housing affordability.

For most Londoners and visitors, however, the pleasure of being able to whizz from one side of London to the other by a new, ultra-modern, high speed rail link will trump any economic or social policy debates. It will be seen above all as an asset to the city and bring pleasure to millions for decades to come.

Become a Gentleman’s Journal Member?

Like the Gentleman’s Journal? Why not join the Clubhouse, a special kind of private club where members receive offers and experiences from hand-picked, premium brands. You will also receive invites to exclusive events, the quarterly print magazine delivered directly to your door and your own membership card.