The challenger banks changing the game

Introducing the world’s most innovative financial institutions; the best bank-breaking brands you should trust with your money

Words: Jonathan Wells

Over the last decade, banking has seen some bold changes. But these changes aren’t to be discerned in our mortgages, investments or insurance policies. They can’t be seen in the subtly shifting interest rates. They can’t even be found in the humble balances of our bank accounts. Rather, they can be found inside our wallets; flashes of hot pink, bright green and iridescent blue heralding a new, more colourful period of personal finance.

From Monese to Monzo, Tandem to Tide, a new wave of start-ups have moved banking off the high-street and onto our smartphones. These ‘challenger’ banks have capitalised on low fees, personalisation and modern, bright design to attract consumers — and are steadily growing their market share.

Among the rainbow of new brands, there are scores of inventive features and systems — from Revolut’s bill-splitting functionality to Starling becoming the first branchless bank to offer interest on their current accounts. But we all know the cards are the main draw. From Tide’s tidy portrait orientation and Transferwise’s neat little notch, to the reassuringly metallic heft of N26’s offering, these are accessories in themselves — calling cards for a new generation of bank-savvy savers.

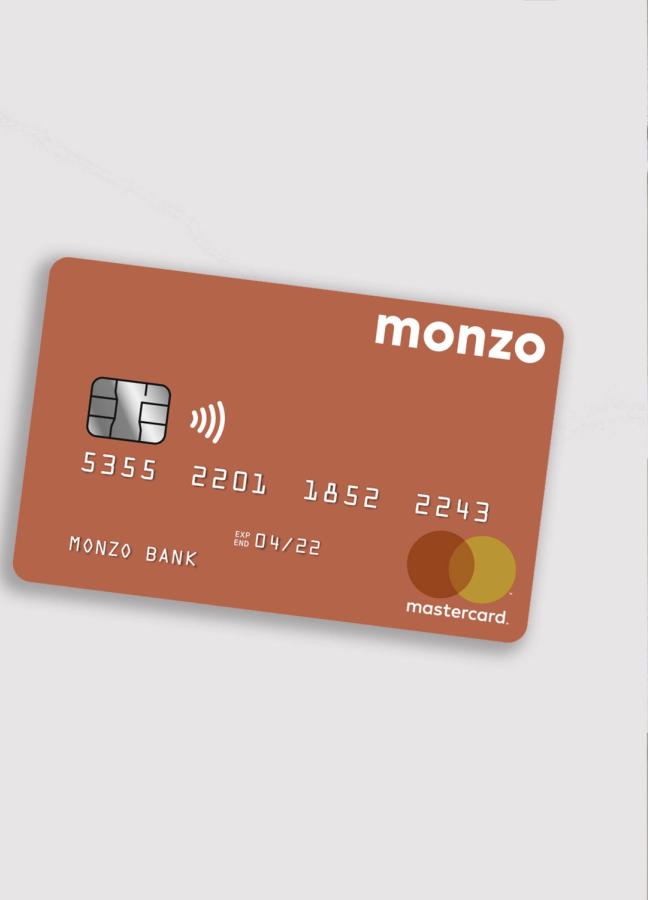

Monzo

Founded: 2015, by Tom Blomfield — who had just been fired from Starling Bank

Features: Savings Pots, Shared Tabs, Automatic Spare Change Saver, Lockable Pots, Budget Tracker

2020 Revenue: £67.2 million

Card colour: Hot Coral

TransferWise

Founded: 2011, by Taavet Hinrikus — Skype’s first ever employee

Features: Support of more than 750 currency routes, Better Exchange Rates, Freezable Debit MasterCard

2020 Revenue: £302.6 million

Card Colour: Borderless Green

Tandem

Founded: 2015, by Ricky Knox — with investment from the Chinese Sanpower Group

Features: Fixed Savings Accounts, Automatic Saving, Roundups, Easy Access Account, Regular Deposit, FSCS Protection

2020 Revenue: £21 million (est)

Card Colour: Orange, Pink, Mint, Teal or Black

Revolut

Founded: 2015, by Nikolay Storonsky and Vlad Yatsenko

Features: Free International Money Transfers, Competitive Conversion Rates, Budgeting and Automatic Saving, Bill-Splitting

2020 Revenue: £175 million (est)

Card Colour: A Purple-Blue hue. Or, for premium members, Silver, Gold, Rose Gold or Black — crafted from a single sheet of reinforced steel

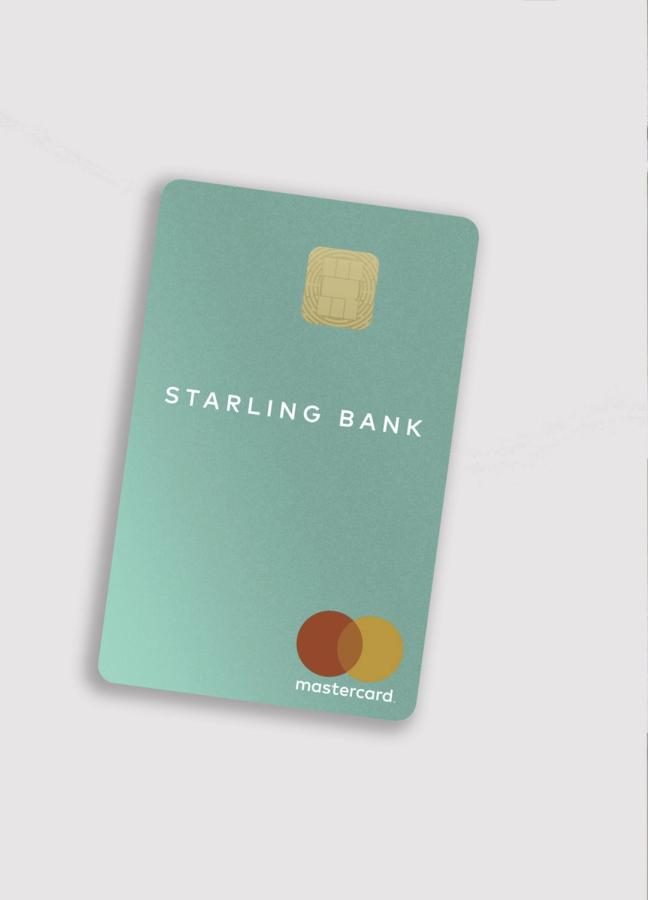

Starling

Founded: 2014, by Anne Boden — with its beta started in partnership with TransferWise

Features: Business Accounts, Cheque Deposits, Saving Goals Notifications, Personal Spending Insights, Bill-Splitting, Post Office Cash Withdrawal

2020 Revenue: £80 million (est)

Card Colour: Vibrant Teal (inspired by the iridescent blue-green tones of the Starling bird’s plumage)

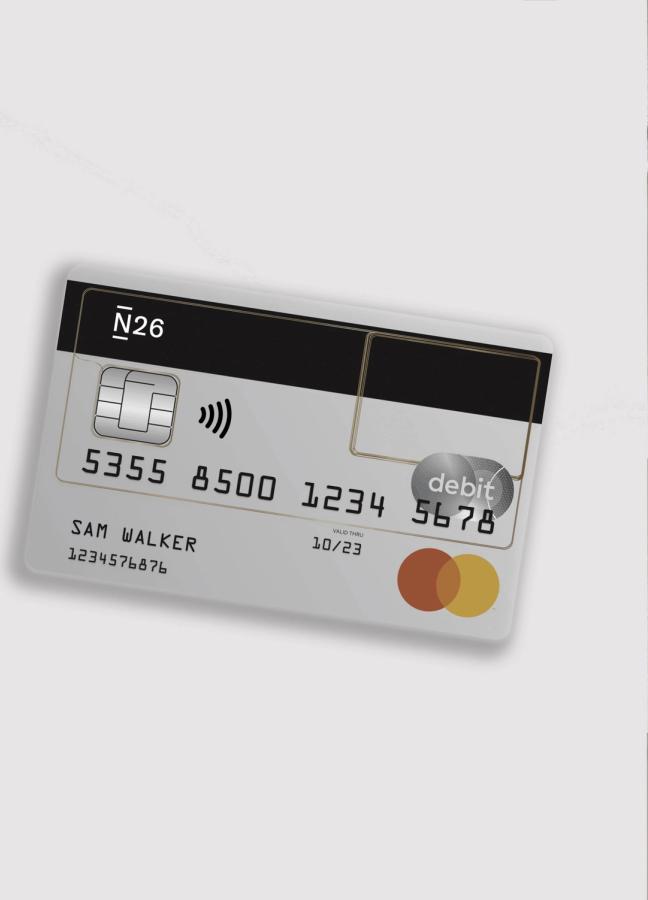

N26

Founded: 2013, by Valentin Stalf and Maximilian Tayenthal — although UK operations have been on hold since Brexit

Features: 100% Mobile Banking, Medical Travel Insurance, Mobility Insurance, Deposit Protection, Savings Pots, Spending Insights

2020 Revenue: £58 million (est)

Card Colour: Transparent

Tide

Founded: 2015, by ex-banker George Bevis

Features: Multiple Accounts, Easy Card Management, Invoice Creation, Desktop App, Accountancy Software Integration

2020 Revenue: N/A

Card Colour: Deep Blue

Monese

Founded: 2015, by Estonian entrepreneur Norris Koppel — after having his application for a current account at a major high-street bank declined

Features: Easy Account Opening, UK Faster Payments Network Access, Competitive Exchange Rates, Budgeting Tools, Savings Pots

2020 Revenue: £5.5 million (est)

Card Colour: Monese Blue

Want more from the banking world? We discover what’s going on at Credit Suisse…

Become a Gentleman’s Journal member. Find out more here.